How Can We Help You Achieve Your Charitable Goals?

5 Step Process to Launch your Fund

1

Read the Specific Fund Flyer

Understand what a Donor Advised Fund, Scholarship Fund, Field of Interest Fund, or Designated Fund is, what’s involved and which one best aligns with your goals.

2

Complete our Fund Development Worksheet

Share your charitable mission, the audience you hope to benefit, any geographic or demographic focus, whether you intend to involve family/accounting, timing (now vs. planned estate), and any other preferences.

3

Review Estimated Timeline of Returns and Funding

We’ll provide a projection that shows how the fund could perform over time — including estimated investment returns, administration/investment fees, and possible distributions/grants.

4

Explore options for contributing to your fund.

You can fund your new account now and begin charitable distributions, or you may establish the fund now but specify that funding begins upon your passing (via planned gift).

5

Decide on establishing a fund now and leave a gift to it, or establish a gift upon your passing.

There are many options available to contribute to your fund today, over time or upon your passing.

1

Learn About Fund Types

Support college or trades students

Through a scholarship fund with Four County Community Foundation, you can invest in the lives of students who are pursuing their dreams. The community foundation provides the expertise to help you meet your personal goals and awards scholarships to deserving students who meet the criteria that you are able to help set. Your gift can help students at all ages and stages pursue education and open new doors to success.

What to lean more? Download our Scholarship Fund Overview

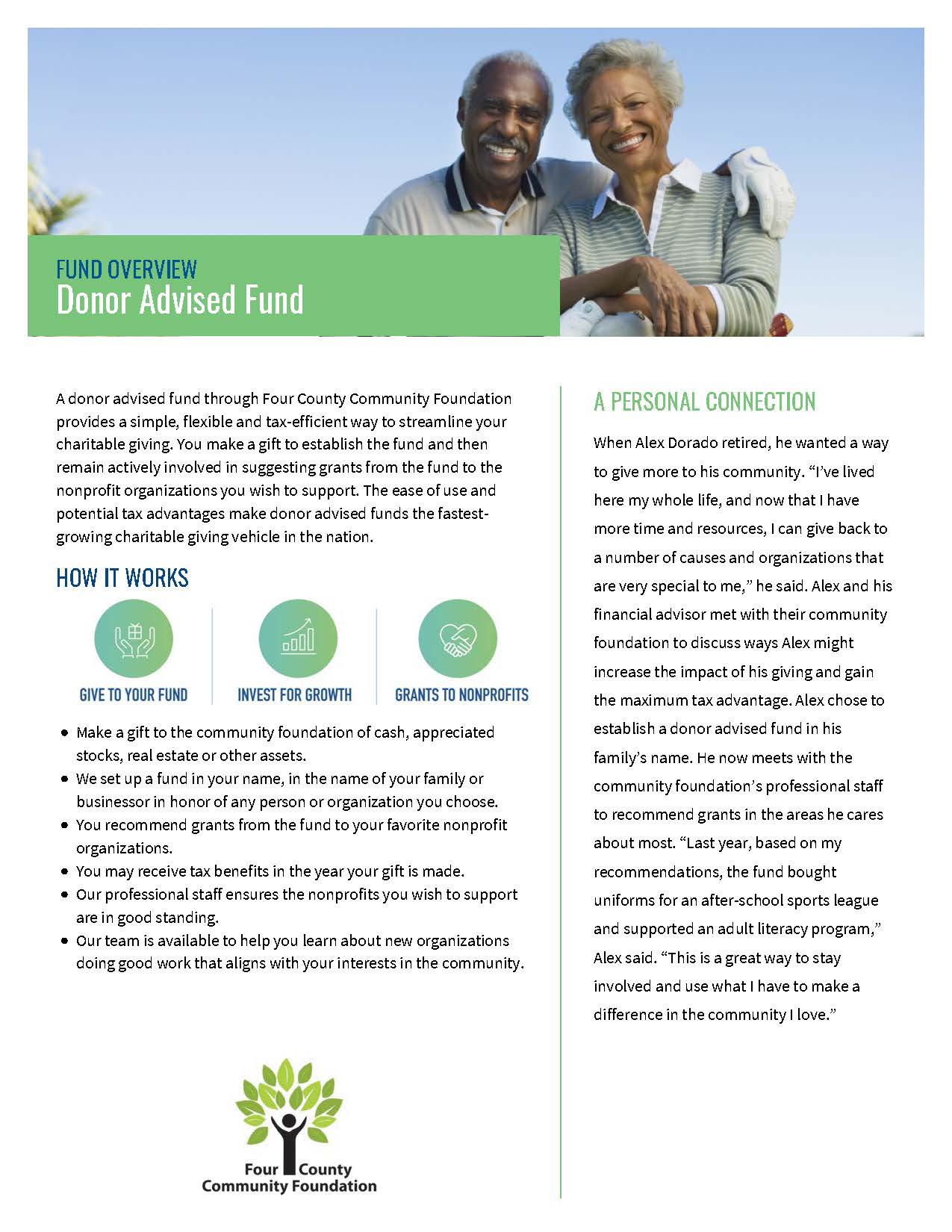

Donor recommends grants to charities

A donor advised fund through Four County Community Foundation provides a simple, flexible and tax-efficient way to streamline your charitable giving. You make a gift to establish the fund and then remain actively involved in suggesting grants from the fund to the nonprofit organizations you wish to support. The ease of use and potential tax advantages make donor advised funds the fastestgrowing charitable giving vehicle in the nation.

What to lean more? Download our Donor Advised Fund Overview

Supports a specific cause or passion

By establishing a field of interest fund with Four County Community Foundation, you can target your gift to address needs in a specific area of community life that matters most to you: arts, environment, children health. You choose.

Our program experts award grants to nonprofits and programs that are making a difference in the area you select. Your gift stays flexible enough to meet community needs in your interest area—even if those needs change over time.

What to lean more? Download our Field of Interest Fund Overview

A non-profit starts this fund and it grants back only to their organization.

Establishing a nonprofit agency endowment fund with Four County Community Foundation is a simple and efficient way to create a source of permanent capital for your organization’s future. These funds offer a reliable, ongoing source of financial support.

Your organization receives the added benefit of our expertise in helping you develop planned giving programs and facilitate complex gifts from your donors. We handle the investment management of the fund and all administrative details, including gift processing, record keeping, tax reporting and audits.

What to lean more? Download our Nonprofit Agency Fund Overview

Donor provides ongoing support for a particular charity.

Establishing a Designated Fund allows you to support the good work of a sepcific nonprofit organization. Becaues it's given through your communty foundation, your gift provides the organization you selectnot only funding, but planned giving and investment management services and the power of endowment.

Want to Learn More? Download our Deginated Fund Overview.

2

Fund Questionaire

3

Review Timeline of Returns and Funding

Return and Funding Calculator

| $ | |

All funds have an annual payout rate of 4% and are subject to an administrative fee of 1.5% and investement fee of .25%

4

Explore Contribution Options

There many options to create and contribute to a fund over time. Some frequently used options are:

1

Cash gifts (check, paypal, venmo, payroll deduction) Consider a recurring monthly gift!

2

Required Minimum Distribution (ira rollover) – you pay no taxes if gift comes directly to 4CCF

3

Appreciated Stock

4

Life Insurance

5

Real Estate

Please review our flyers to learn about your many giving options

Including a charitable bequest in your will or estate plan allows you to make a gift to Four County Community Foundation that will forever leave your mark on the community. Your bequest can be used to establish a special fund that supports broad community needs or focuses on a particular issue or cause that matters to you. Your bequest will benefit the community forever and become part of your personal legacy of giving.

Planned gifts made upon your passing are included as either a percent or pre-determined amount that will be made from your estate.

Please review our flyer to learn about planned gifts

5

Make a Decision and Contact Us

Now

If your answer to Step 4 is now and you're decided to move forward with establishing a fund or want to contribute to an existing fund, please contact Kathy Dickens below.

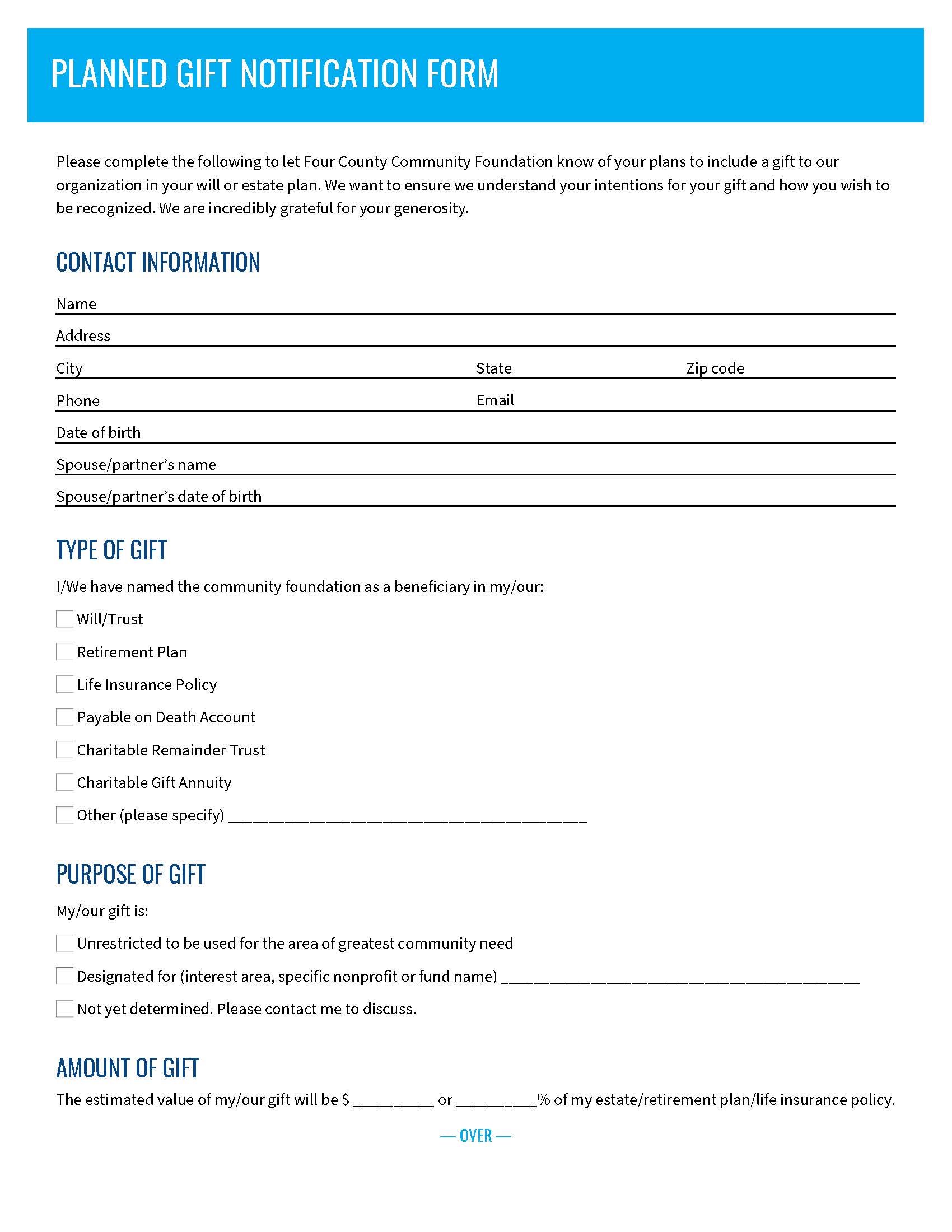

Upon your passing

If your answer in Step 4 is upon your passing that you plan to make your gift, please complete our PlannedGift Notification form. Once the form has been completed, please send an email with the attatched form(s) to Kathy Dickens.

General FAQ

Minimums by fund type over first five years

$15,000 all funds, except for scholarship funds which are endowed at $25,000

What happens to my fund if a named charity ceases or I pass away?

Successor Advisors are named, funds will go to mission aligned non-profit organizations

Can I convert my private foundation to a fund with your foundation?

Yes, refer to DAF option

What are the fees associated with new funds?

- 1.5% administrative fee

- 0.25% investment fee

These fees are built into the calculator above.

What is an endowed fund?

Endowed Funds are intended to exist forever. The original money (the principal) is kept permanently, and only the investment earnings are used to support the charity’s work.

How is a non-endowed fund different?

A non-endowed fund is also invested to realize interest to the fund, but the entire fund balance is available to spend.

How long does it take to establish a fund?

Our fund agreements are 3-4 pages in length and can be finalized within a short timeframe (often within days). See a fund agreement template here.

Can I remain anonymous?

Yes, you can remain anonymous.